Business Insurance in and around Denver

Get your Denver business covered, right here!

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate accident, like an employee getting injured on your business's property.

Get your Denver business covered, right here!

Cover all the bases for your small business

Surprisingly Great Insurance

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or worker's compensation for your employees, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Barb Frank can also help you file your claim.

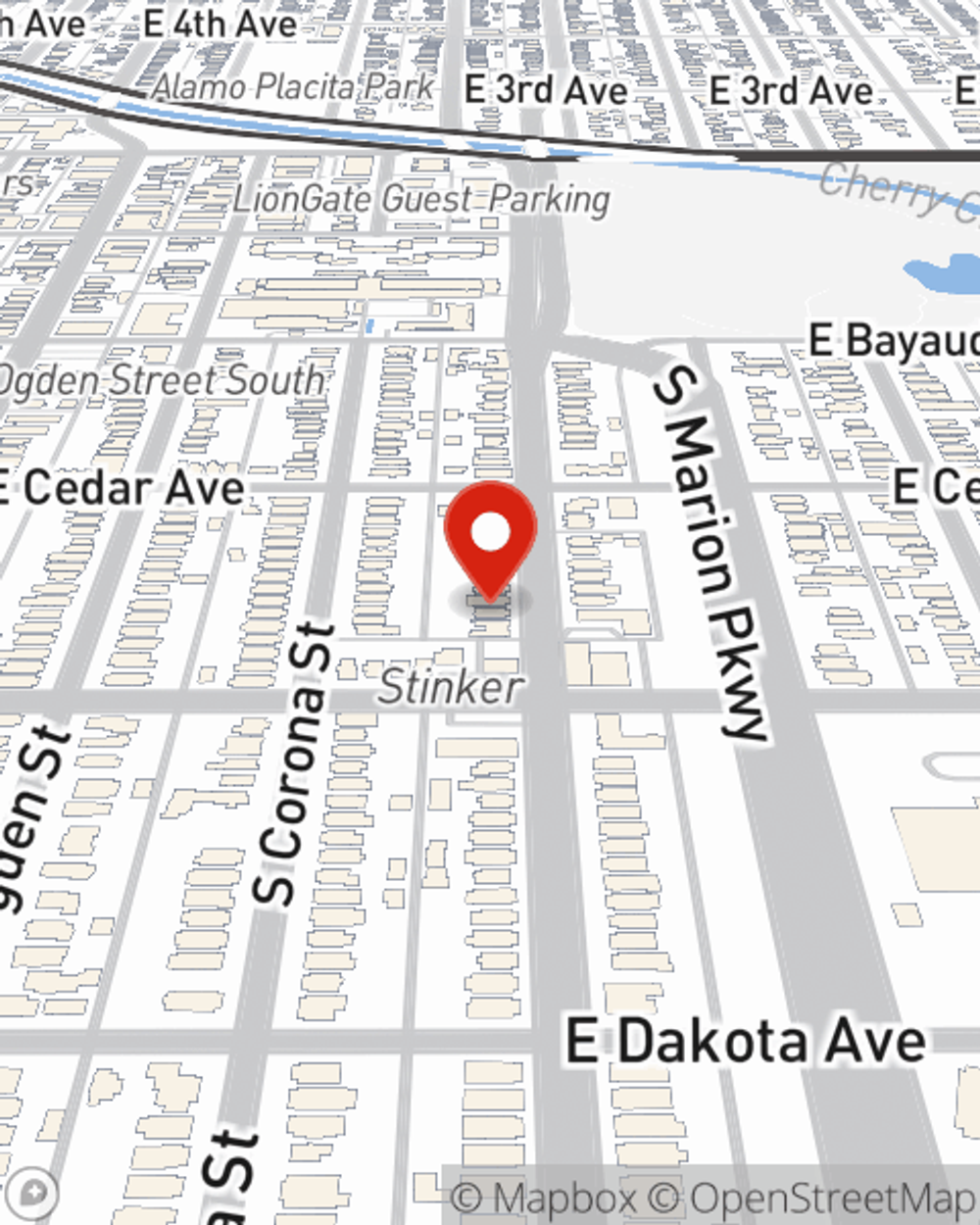

So, take the responsible next step for your business and visit with State Farm agent Barb Frank to identify your small business insurance options!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Barb Frank

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.